Click here to read this mailing online.

Here are the latest updates for jorgeus.george@gmail.com

"Next Big Future" - 3 new articles

"Next Big Future" - 3 new articles

- If oil prices were to drop the important geopolitical impact would be on Russia

- What would it take for synthetic biofuels to significantly alter geopolitics ?

- Joule is making commercial scale direct solar conversion biofuel plants starting in 2014

- More Recent Articles

- Search Next Big Future

- Prior Mailing Archive

If oil prices were to drop the important geopolitical impact would be on RussiaIf shale oil, shale gas and synthetic biofuels were to rapidly scale and significantly lower the price of oil this would have interesting geopolitical impacts on Russia. The Iran, Saudi Arabia impacts would also be interesting but a weaker Russian economy would matter more for geopolitics. 20-25% of Russia's GDP is tied to the oil and gas sector.

The importance of oil exports and hydrocarbon exports in general to the Russian economy arises along several channels. Income from crude has accounted for a significant share of Russian export revenues increasing from 25 per cent in 2000 to more than 35 per cent in 2008. Total hydrocarbon exports (inclusive natural gas and petrochemicals) accounted for 65 per cent of total export revenues in 2008. Fjærtoft (2008) found evidence that the price of crude is a key driving force behind Russia’s trade flow driven exchange rate. This finding is supported in the present paper. Hydrocarbon exports generated 50 per cent of federal budget revenues in 2008 (EEG 2009) and the governments scope of manoeuvre is directly linked to the price of crude. On a larger scale the oil and gas sector is estimated to account for 20–25 per cent of GDP (Anker and Sonnerby 2008). The oil and gas sector also accounts for an important share of investment demand (World Bank 2008).

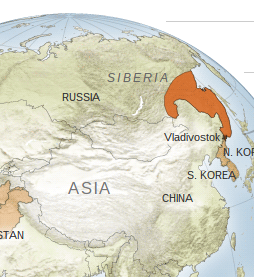

IEA oil projection to 2035 was for $125/barrel in real terms Global oil demand grows by 7 mb/d to 2020 and exceeds 99 mb/d in 2035, by which time oil prices reach $125/barrel in real terms (over $215/barrel in nominal terms). A surge in unconventional and deepwater oil boosts non-OPEC supply over the current decade, but the world relies increasingly on OPEC after 2020. Iraq accounts for 45% of the growth in global oil production to 2035 and becomes the second-largest global oil exporter, overtaking Russia. Oil demand was projected to increase by 14 percent between now and 2035. Weaker economy and weak demographics could result in a loss of chunks of Siberia to China Russia’s greatest geopolitical fear is fed by a very plausible scenario — China, populous and resource-hungry, taking over large chunks of Siberia, part of Russia’s failing and emptying East. Hundreds of thousands of Chinese have already crossed the border at the Amur River and set up trading settlements, intermarrying with Russians and Siberia’s native nomadic minorities. Russia has a nuclear arsenal with which to fend off formal threats to its sovereignty, but the demographic imbalance is to Russia’s disadvantage and could accelerate the economic shift in China’s favor. Russia’s far eastern outpost of Vladivostok is ever more distant from Moscow. Will it become a Russian enclave in a re-Sinofied “Outer Manchuria,” like Kaliningrad, 5,000 miles away on the Baltic Sea, a Soviet fragment stranded inside the European Union? Read more » What would it take for synthetic biofuels to significantly alter geopolitics ?Brazil and the United States lead the industrial production of ethanol fuel, accounting together for 87.8 percent of the world's production in 2010, and 87.1 percent in 2011. In 2011 Brazil produced 21.1 billion liters (5.57 billion U.S. liquid gallons), representing 24.9 percent of the world's total ethanol used as fuel.

In 2012, Americans consumed 134 billion gallons of gasoline that contained approximately 13 billion gallons of ethanol (a blend rate of 9.7%), according to the Energy Information Administration. Accounting for ethanol's reduced energy content per gallon -- just 67% of a gallon of gasoline -- we can say that ethanol blending displaced 8.7 billion gallons of gasoline last year.

The world consumes over 85 million barrels of oil every day (over 30 billion barrels per year). The USA alone consumes over 20 million barrels per day (over 7 billion barrels per year). The world uses about 600 billion gallons of gasoline. Getting to 10 to 15% ethanol blends worldwide would mean a 60 to 90 billion gallon market for ethanol. Going beyond that level would mean a shift to flexfuel car engines that could handle more pure ethanol. Synthetic biology can directly produce diesel fuel. Massive geopolitical altering success with synthetic biofuels even at 25,000 gallons per acre would require about 3,000,000 acres to get to 75 billion gallons per year. This would just over half of US gasoline usage. Shale oil also has some projections where it gets to those kinds of levels or higher. The price for crude oil would get impacted because of reduced demand. Read more » Joule is making commercial scale direct solar conversion biofuel plants starting in 2014Joule is deploying a revolutionary platform for renewable fuel and chemical production that is expected to eclipse the scalability, productivities and cost efficiency of any known alternative to fossil fuel today.

Joule capitalizes on the global abundance of waste CO2 to economically produce renewable fuels and chemicals. The company’s Sunflow™ products drop into conventional fuel blendstock in high percentages, displacing more oil than biofuels and allowing seamless adoption. Manufactured without feedstock constraints or complex processing, Sunflow fuels achieve high volumes and low costs with no dependence on subsidies or precious natural resources. Through its subsidiaries, Joule Unlimited Technologies and Joule Fuels, the company advances both technology development and commercial deployment to achieve market impact as soon as 2015.

Commercial scale should be 1000 acre plants. This should mean 25 million gallons per year of Sunflow-E (ethanol replacement). Upon full-scale commercialization, the company ultimately targets 25,000 gallons of Sunflow™-E and 15,000 gallons of Sunflow™-D per acre annually, for as little as $1.28/gallon and $50/barrel respectively (excluding subsidies). These products will directly address the global markets for ethanol and diesel fuel without the economic or environmental consequences of their biomass- or fossil-derived counterparts. Joule has successfully pilot-tested its platform for over two years, commissioned its SunSprings™ demonstration plant, and launched a global subsidiary, Joule Fuels, to deploy fuel production sites worldwide. Construction of the first commercial plants is expected to begin in 2014. To date, renewable hydrocarbon-based fuel substitutes have required the complex, multi-step conversion of algal or other agricultural biomass feedstocks into fuel pre-cursors, and subsequent chemical upgrading. In contrast, Joule has engineered photosynthetic biocatalysts that convert waste CO2 into hydrocarbons through a patented, continuous process. Joule has been successfully scaling its process for making ethanol (Sunflow-E) while also developing long-chain hydrocarbons for diesel (Sunflow-D). With its latest breakthrough, Joule becomes the first company able to directly produce medium-chain hydrocarbons which are substantial components of gasoline (Sunflow-G) and jet fuel (Sunflow-J). Read more » More Recent Articles

|